Market Pulse: Danish Crown's Strong Half, ASF in Germany, and Tesco's Welfare Report

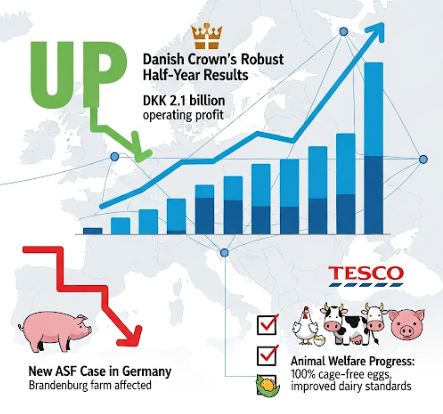

Danish Crown posts robust H1 results but warns of cost pressures, a new ASF case hits Germany, and Tesco details its animal welfare progress.

Corporate Strategy: Danish Crown Posts Strong H1 but Warns of Cost Pressures

What happened: European processing giant Danish Crown has reported robust financial results for the first half of 2025, with revenue up 5% year-on-year. The growth was driven by strong performance in its fresh pork and processing divisions. However, the company's leadership has warned of a challenging second half, citing rising feed costs and global economic uncertainty as significant risks to future profitability.

Why it matters: As one of Europe's largest processors, Danish Crown's performance is a key barometer for the entire industry. Their positive results show that consumer demand for pork remains solid, but the warning on costs signals that margin pressure is a major concern for even the largest players. The company's continued focus on investing in sustainability and automation to improve efficiency is a clear indicator of its long-term strategy.

Implications & suggested actions:

Farmers & Suppliers: Strong performance at Danish Crown means continued stable demand for pigs. However, the warnings on feed costs are a clear signal that processors will be highly focused on procurement costs in the coming months.

Processors: Danish Crown's results confirm the challenging operating environment. Competitors should benchmark their own performance and heed the warning on input costs. Investing in automation and efficiency measures is crucial to protect margins.

Wholesalers & Retailers: Expect processors to be firm on pricing for the remainder of the year as they seek to pass on higher input costs. This will likely keep wholesale meat prices elevated.

Animal Health: New ASF Case Confirmed in Germany

What happened: A new case of African Swine Fever (ASF) has been confirmed in a domestic pig herd in the state of Brandenburg, Germany. The outbreak occurred on a farm with approximately 200 animals. Authorities have implemented immediate control measures, including establishing restricted zones and culling the affected herd, to prevent further spread.

Why it matters: Any new ASF case in a major pork-producing nation like Germany sends ripples through the EU market. It heightens the risk of wider trade restrictions, both within the EU and from key international partners, and puts intense pressure on regional prices. The summer months are a high-risk period for ASF transmission, and this new case serves as a critical reminder for all producers to maintain the highest levels of biosecurity.

Implications & suggested actions:

Farmers (EU-wide): This is a red alert for biosecurity. Immediately review and reinforce all on-farm protocols, particularly those related to vehicle movements, personnel, and feed sources. Do not become complacent.

Processors: Verify the health status and origin documentation for all incoming livestock with extreme diligence. Expect potential disruptions to supply from the affected regions and be prepared for heightened surveillance measures at your facilities.

Wholesalers & Exporters: Prepare for the possibility of new export restrictions or additional certification requirements from non-EU countries. Maintain clear and constant communication with your suppliers to stay ahead of any trade disruptions.

Retail & Sourcing: Tesco Reports Progress on Animal Welfare

What happened: UK retail giant Tesco has published its annual animal welfare report, detailing its progress and future commitments. Key achievements include a 60% reduction in antibiotic use in its supply chain since 2017. The retailer also highlighted its move to a new, five-tier welfare standard for chickens ("Tesco welfare-approved") and reaffirmed its commitment to sourcing 100% of its own-label fresh pork from farms that meet RSPCA Assured standards.

Why it matters: As the UK's largest retailer, Tesco's sourcing policies have a huge influence on industry standards and farm practices. Their focus on reducing antibiotic use reflects a major consumer and public health trend, while the creation of their own tiered welfare standard for poultry shows a desire to create a clear "good, better, best" proposition for customers, moving beyond basic compliance.

Implications & suggested actions:

Farmers & Suppliers: If you are in the Tesco supply chain, aligning with these evolving welfare and antibiotic use standards is essential for maintaining your business. For those not supplying Tesco, these policies are a strong indicator of the direction of travel for the entire retail sector.

Processors: Ensure your sourcing and traceability systems can robustly differentiate between various welfare standards (e.g., standard, Tesco welfare-approved, RSPCA Assured). This is now a critical part of servicing major retail accounts.

Wholesalers & Food Service: The trends being set by major retailers like Tesco will eventually filter down to the food service and cash-and-carry sectors. Be prepared for increasing customer demand for products with strong welfare and provenance credentials.

Sources

Danish Crown H1 2025 Financial Results - GlobalMeatNews (12 August 2025)

ASF Germany: first case of ASF in wild boar in Oberhavel (Brandenburg) - Pig333.com (July 2025)

Tesco Animal Welfare Update & Future Commitments - Tesco PLC (August 2025)